What Does Property By Helander Llc Do?

Table of ContentsThe 2-Minute Rule for Property By Helander LlcProperty By Helander Llc Things To Know Before You Get ThisThe 5-Second Trick For Property By Helander LlcWhat Does Property By Helander Llc Mean?4 Simple Techniques For Property By Helander Llc7 Easy Facts About Property By Helander Llc Shown

The benefits of buying property are numerous. With appropriate assets, investors can take pleasure in predictable capital, exceptional returns, tax benefits, and diversificationand it's feasible to take advantage of realty to develop riches. Considering investing in realty? Right here's what you require to find out about property benefits and why real estate is taken into consideration an excellent financial investment.The advantages of purchasing actual estate include easy revenue, steady cash money circulation, tax obligation benefits, diversity, and take advantage of. Real estate investment depends on (REITs) provide a way to purchase realty without needing to possess, operate, or money residential or commercial properties - (https://www.magcloud.com/user/pbhelanderllc). Cash circulation is the take-home pay from an actual estate financial investment after home mortgage payments and operating costs have been made.

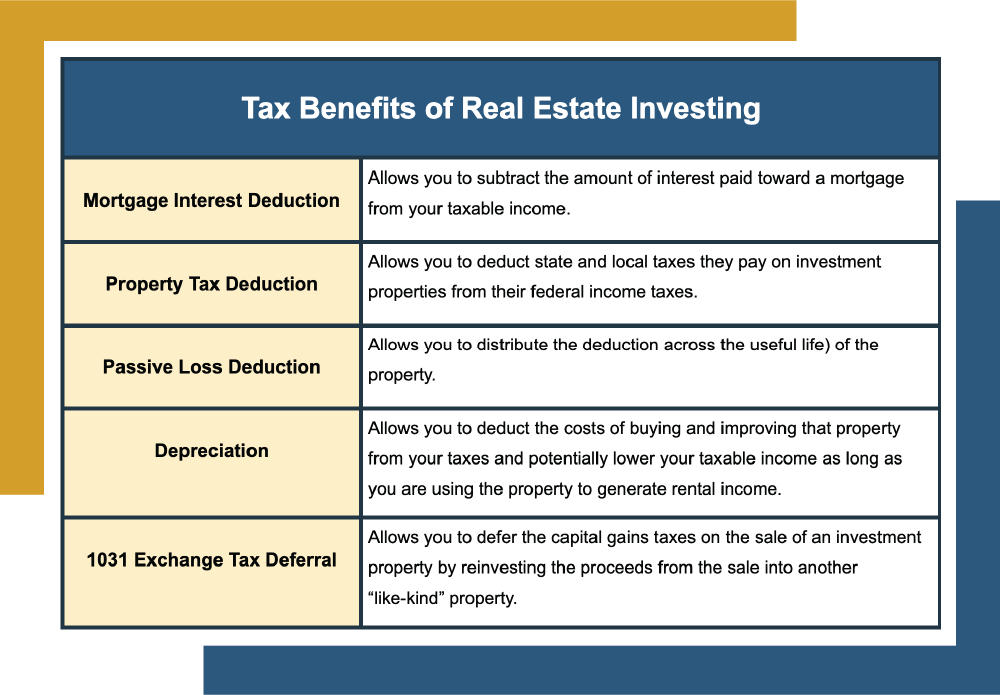

In most cases, cash flow only enhances in time as you pay down your mortgageand construct up your equity. Genuine estate financiers can benefit from countless tax obligation breaks and deductions that can save money at tax obligation time. In general, you can subtract the sensible expenses of owning, operating, and taking care of a residential property.

The smart Trick of Property By Helander Llc That Nobody is Discussing

Real estate worths have a tendency to enhance over time, and with a good financial investment, you can transform an earnings when it's time to offer. As you pay down a building home loan, you construct equityan property that's part of your web well worth. And as you develop equity, you have the utilize to purchase more buildings and increase cash money circulation and wealth even much more.

Because realty is a tangible property and one that can work as security, funding is easily available. Real estate returns vary, depending upon aspects such as area, asset course, and administration. Still, a number that many capitalists go for is to defeat the ordinary returns of the S&P 500what lots of people refer to when they claim, "the market." The rising cost of living hedging capacity of actual estate stems from the favorable connection in between GDP growth and the demand for genuine estate.

The Buzz on Property By Helander Llc

This, consequently, translates right into greater capital worths. Therefore, property has a tendency to maintain the purchasing power of resources by passing some of the inflationary pressure on renters and by including a few of the inflationary pressure in the type of capital admiration. Mortgage borrowing discrimination is unlawful. If you think you've been differentiated versus based upon race, faith, sex, marital condition, use public aid, national beginning, handicap, or age, there are actions you can take.

Indirect actual estate investing involves no straight possession of a residential or commercial property or residential properties. There are a number of ways that owning genuine estate can protect versus inflation.

Homes funded with a fixed-rate funding will see the family member amount of the month-to-month mortgage repayments fall over time-- for circumstances $1,000 a month as a fixed settlement will certainly come to be much less difficult as inflation erodes the buying power of that $1,000. (https://us.enrollbusiness.com/BusinessProfile/6910118/Property%20By%20Helander%20LLC). Frequently, a key home is ruled out to be a genuine estate financial investment because it is utilized as one's home

The 45-Second Trick For Property By Helander Llc

Also with the help of a broker, it can take a few weeks of work just to find the best counterparty. Still, genuine estate is an unique property class that's straightforward to understand and can enhance the risk-and-return profile of a capitalist's portfolio. By itself, genuine estate supplies capital, tax obligation breaks, equity building, competitive risk-adjusted returns, and a bush versus inflation.

Spending in property can be an exceptionally fulfilling and lucrative venture, but if you're like a lot of new financiers, you may be wondering WHY you must be investing in actual estate and what advantages it brings over various other financial investment opportunities. In enhancement to all the incredible benefits that come along with spending in real estate, there are some downsides you require to consider.

Our Property By Helander Llc Statements

At BuyProperly, we use a fractional possession version that enables investors to begin with as little as $2500. One more major advantage of genuine estate investing is the capability to make a high return from purchasing, remodeling, and re-selling (a.k.a.

Most flippers the majority of fins undervalued buildings underestimated structures neighborhoodsWonderful The wonderful point concerning spending in real estate is that the value of the residential or commercial property is anticipated to appreciate.

The Only Guide for Property By Helander Llc

If you are billing $2,000 lease per month and you incurred $1,500 in tax-deductible expenditures per month, you will only be paying tax on that $500 profit per month (sandpoint idaho realtor). That's a big distinction from paying taxes on $2,000 each month. The revenue that you make on your rental for the see this site year is thought about rental earnings and will certainly be strained accordingly